3. Februar 2022

Vancouver, British Columbia–(Newsfile Corp. – February 3, 2022) – GoviEx Uranium Inc. (TSXV: GXU) (OTCQB: GVXXF) („GoviEx“ or the „Company„) is pleased to announce its 2022 drilling programme at the polymetallic copper-silver-uranium Falea Project in Mali. GoviEx has engaged Foraco Mali to undertake exploration drilling, focusing on targets based predominantly on the induced polarisation („IP„) surveys completed on the Falea Project in 2020 and 2021.

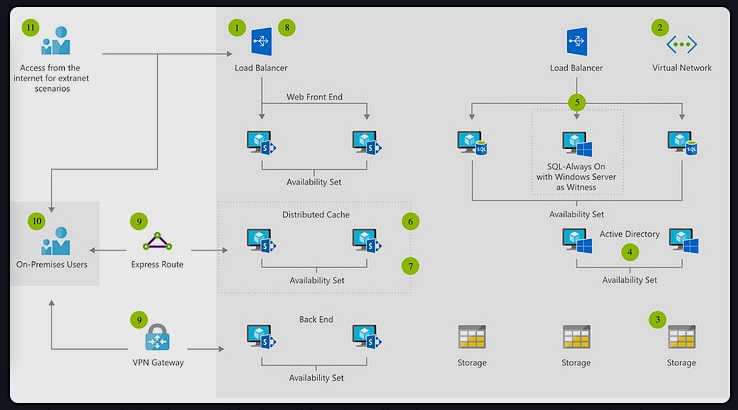

In December 2020 and August 2021, the Company announced the results of geophysical survey and data inversion analysis by Computational Geosciences, which highlighted a large chargeable body over 2 km in length and 500 m wide underneath the deposit on the Falea Project adjacent to the Road fault. Additionally, the results of the geophysics highlighted a second anomaly aligned with a structural feature associated with the Siribaya trend as well as potential for a chargeable body in the northeast area of the Bala exploration license. The IP data highlights the much shallower depth to basement and associated unconformity. The geophysical results corroborated geological interpretation that both Falea and Bala licenses appear to be highly prospective for increased polymetallic uranium-copper-silver mineralization.

In addition, an assay program of historical diamond drill cores below the known uranium mineralisation of the deposit, report both copper and gold mineralisation. It is believed that the deposit results from mineralising fluids intruded via the faults in the area to deposit at suitable trap sites at the unconformity within the overlying rocks. Previous historical drilling programmes have not tested for the presence of mineralised bodies below the unconformity within the Birimian. These will now be tested during our drilling campaign.

Govind Friedland, Executive Chairman of GoviEx, said:

„We are extremely excited to start testing the real potential of Falea and Bala with our 2022 drilling program. The IP results and initial samples indicate that our current known resources could be just the tip of the iceberg on this deposit, which already contains 31 million pounds of uranium, 63 million pounds of copper and 21 million ounces of silver.“ (1)

„We remain strong believers in the copper, silver and of course uranium market fundamentals and we are only just beginning to see its true growth as we enter a period of prolonged inflation and tightening of supply chains. GoviEx remains well positioned and offers significant value and exposure to the forecast deficit of critical energy transition metal supply for the future.“

The Falea Project consists of three Exploration Licenses; Falea, Bala and Madini, in southwest Mali and is situated along strike to a number of gold mines and exploration projects and the Saraya East uranium project in Senegal (Figure 1). The Falea polymetallic mineralisation contains uranium, copper, and silver that has been defined at or near the unconformity between the Taoudeni basal sediments and the underlying metamorphic rocks of the Birimian aged sequences. Drilling that stopped only a few metres beyond the ore body – but within the Birimian rocks – are shown to contain copper and gold based on assays received to date.

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/5017/112671_7bc1923964efcaaf_001full.jpg

Foraco Mali has been contracted to carry out 6,000 metres of diamond core drilling to an average depth of 600 metres, focused on two geophysical anomalies within the Birimian sequence below the Falea polymetallic deposit on the Falea licence and one anomaly on the Bala licence. The program is expected to take six months to complete.

The local geological team has been on site during January 2022, carrying out sampling of the Birimian section of existing core from drill holes that overlie and come close to the IP anomaly, following on from the initial work completed and reported in 2020.

Visual examination of the historical cores within the Birimian shows that it is extensively veined and sheared (Figures 2 and 3), with evidence of copper and gold mineralisation.

Bitte lesen Sie die komplette Pressemeldung unter dem folgenden Link: LINK