Blue Sky Reports Significant Vanadium Zone at the Anit Target, Amarillo Grande Project, Argentina

08.11.2017

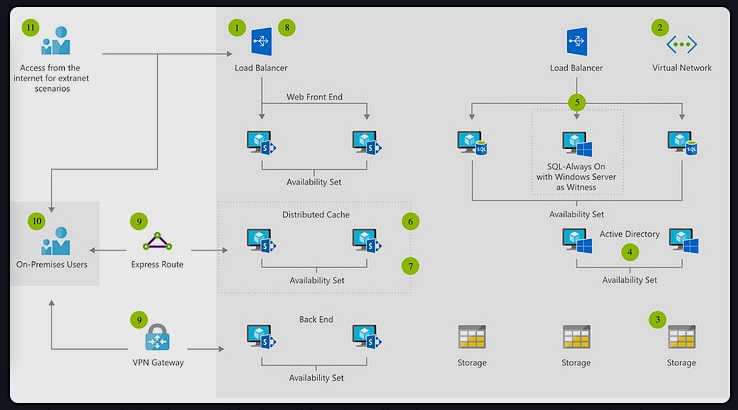

Vancouver, BC / Marketwired / November 8, 2017 / Blue Sky Uranium Corp. (TSX-V: BSK, FSE: MAL2; OTC: BKUCF), „Blue Sky“ or the „Company“) is pleased to report that the integration of the 2017 Phase I drill results at the Anit target (see News Release dated September 18, 2017) with data from previous sampling programs carried out by the Company has led to the delineation of a significant area of vanadium mineralization, covering a much larger area than the previously defined uranium mineralized zone (see Figure 1: https://www.blueskyuranium.com/assets/news/2017-11-08-nrm1-bsk-h8nb22.pdf).

“The current market interest in vanadium as a component of storage batteries for renewable energy has helped spur a significant price increase over the last year,” stated Nikolaos Cacos, Blue Sky President & CEO. “These results confirm the regional potential of Amarillo Grande where two significant uranium-vanadium discoveries have been made by the Company. Amarillo Grande covers a one hundred and forty kilometre trend where there is potential for many more discoveries.”

RC Drill intercepts from Phase I yielded strong vanadium mineralization, including:

- 3,411 ppm V2O5 over 1 m

- within 560 ppm V2O5 over 10 m in AGA-0049

- 2,510 ppm V2O5 over 1 m

- within 810 ppm V2O5 over 16 m in AGA-0059

- 2,508 ppm V2O5 over 1 m

- within 930 ppm V2O5 over 08 m in AGA-0060

- 2,367 ppm V2O5 over 1 m

- within 876 ppm V2O5 over 13 m in AGA-0058

- 2,349 ppm V2O5 over 1 m

- within 859 ppm V2O5 over 08 m in AGA-0078

- 2,190 ppm V2O5 over 1 m

- within 685 ppm V2O5 over 12 m in AGA-0050

- 2,085 ppm V2O5 over 1 m

- within 616 ppm V2O5 over 11 m in AGA-0051

- 2,074 ppm V2O5 over 1 m

- within 746 ppm V2O5 over 09 m in AGA-0056

- 2,030 ppm V2O5 over 1 m

- within 847 ppm V2O5 over 08 m in AGA-0049

About Vanadium

Vanadium is traditionally used as a hardening additive in steel manufacturing. More recently, vanadium has become the main constituent of vanadium redox flow storage batteries. Storage batteries are a key component in the sustainability of renewable, but intermittent, energy sources such as wind and solar, which are expected to see increasing future market share[i]. The current market supply of vanadium is mainly from China, where supply reportedly tightened in the last year. These and other factors have resulted in prices of Vanadium surging over the past year[ii], [iii].

Program Details, Anit Zone, Amarillo Grande Project

The Phase I program recently carried out at Anit included a pole-dipole electrical tomography (ET) geophysical survey and 1170 metres of Reverse Circulation (RC) drilling in 83 holes drilled to a maximum depth of 20 metres. Results from these holes were previously released (see September 18, 2017 news release), however the interpretation was focused on uranium and therefore intervals were reported only when uranium was greater than 30ppm over more than 1 metre. Re-interpreted results focused on Vanadium intervals >250ppm over 1 metre, are reported in Table 1: https://www.blueskyuranium.com/assets/news/2017-11-08-nrt-bsk-h8nb22.pdf . All holes were vertical and as such, reported mineralized intercepts are believed to approximate true thickness.

Previous exploration efforts, carried out by the Company at Anit between 2008 and 2010, included airborne radiometric surveying, pit and trench sampling, radon gas surveys and auger and aircore drilling along a 15 kilometre-long airborne radiometric anomaly related to a surficial paleo-channel. (For details of these programs please refer to the NI 43-101 Technical Report filed on SEDAR dated May 29th, 2012.) The primary focus of work at the Anit target to date has been on near-surface uranium mineralization related to the uranium-vanadium mineral carnotite (K2(UO2)2(VO4)2·3H2O) which occurs as coatings on grains and interstitially in weakly-consolidated medium-grained sands which have been sampled from surface to approximately 20 metres depth. Integration of the data has shown that elevated vanadium is distributed over a wider area with greater thickness than the main zone of uranium mineralization concentrated in the core of the paleo-channel; more work is required to determine the extent and mineralogy of the vanadium mineralization.

Using a 1,000ppm V2O5 x metre isocurve as a lower limit defines an open area covering approximately 3 kilometres by 1 kilometre within which the mineralized interval ranged between 0 and +16 metres in thickness (see Figure 2: https://www.blueskyuranium.com/assets/news/2017-11-08-nrm2-bsk-h8nb22.pdf). Initial interpretation of the observed spatial and quantitative relationship between the two metals may relate to initial concentration of vanadium-rich minerals in the paleochannel system, likely as vanadium-bearing oxide and/or hydroxide minerals, and subsequent formation of carnotite, incorporating a portion of the available vanadium upon introduction of uranium.

Additional exploration work to advance understanding of the mineralogy, metallurgical characteristics, grade and aerial extent of the vanadium mineralization at the Anit target will be incorporated into the Phase 2 exploration program. This work will include ground geophysics, RC drilling and mineralogy/metallurgical studies.

Methodology and QA/QC

Preparation of all samples reported herein was completed Bureau Veritas Minerals of Mendoza, Argentina. Samples were prepared by drying, crushing to 80% passing 10 mesh and then pulverizing a 250 g split to 95% passing 150 mesh. Pulps were analyzed by Bureau Veritas Commodities Canada Ltd. for 45 elements by means of Inductively Coupled Plasma Mass Spectrometry following a four-acid digestion (MA-200). Approximately every 10 th sample a blank, duplicate, or standard sample was inserted into the sample sequence for quality assurance/quality control (QA/QC) purposes. No significant QA/QC issues were identified during review of the data.

The drilling program been carried out using an FlexiROC D65 drill rig from Atlas Copco, an ore-control track-mounted rig adapted to reverse circulation with triple cyclone to reduce the dust loss during sampling and automatic sampling. Every hole was surveyed by a senior geophysicist from Geopehuen SRL Service Company using a natural gamma probe from Geovista Ltd. The probe was previously calibrated at the Comisión Nacional de Energía Atómica facility (Atomic Energy National Commission, CNEA).

About the Amarillo Grande Project

This new uranium district was first identified, staked and underwent preliminary exploration by Blue Sky from 2007 to 2012 as part of the Grosso Group’s strategy of adding alternative energy focus to its successful portfolio of metals exploration companies. The proximity of several major targets suggests that if resources are delineated a central processing facility would be envisioned. The area is flat-lying, semi-arid and accessible year-round, with nearby rail, power and port access.

Mineralization identified to date at Amarillo Grande has characteristics of sandstone-type and surficial-type uranium-vanadium deposits. The sandstone-type deposit is related to a braided fluvial system comprising a potentially district-size “roll front” system. Uranium minerals are present in the porous of poorly-consolidated sandstones and conglomerates. In surficial-type uranium deposits, carnotite mineralization coats loosely consolidated pebbles of sandstone and conglomerates. Carnotite is amenable to leaching, and preliminary metallurgical work at the project indicates that the mineralized material can be upgraded using a very simple wet screening method. The near-surface mineralization, ability to locally upgrade, amenability to leaching and central processing possibility suggest a potentially low-cost development scenario for a future deposit.

For additional details on the project and properties, please see the Company’s website: www.blueskyuranium.com

Bitte lesen Sie die komplette Pressemeldung unter dem folgenden Link: LINK

Der Beitrag Blue Sky Uranium meldet signifikante Vanadium-Zone an der ‚Anit Zone‘ beim ‚Amarillo Grande Projekt‘, Argentinien erschien zuerst auf uranaktien.info.